PioneerMarkts.com Scam Review – A Suspicious Broker

In today’s booming digital trading world, the allure of fast profits and elite trading tools draws countless investors online. PioneerMarkts.com positions itself as a premium brokerage promising high returns, advanced trading platforms, and access to global financial markets. However, beneath its professional design and persuasive language, there are numerous indicators that suggest this platform may be a scam.

This review examines PioneerMarkts.com in detail, exploring its operations, warning signs, and client experiences while providing insights into why investors should approach it with extreme caution.

First Impressions – A Polished Exterior

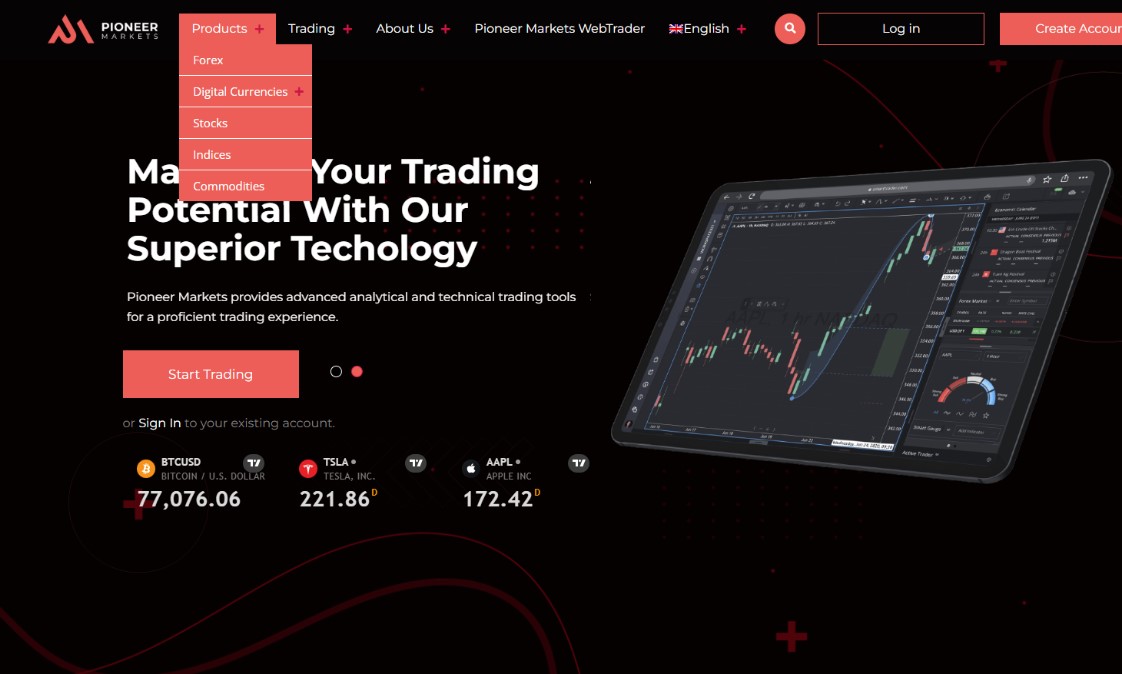

Upon visiting PioneerMarkts.com, the first impression is one of sophistication. The website features modern graphics, interactive dashboards, and statements like “Trade Smarter, Earn Faster” and “Your Gateway to Global Markets”. The homepage suggests credibility and expertise, creating an aura of professionalism that can easily entice inexperienced investors.

Yet, this polished exterior is often a tool for deception. Many fraudulent platforms invest heavily in design and marketing to mask the lack of transparency and accountability beneath the surface. PioneerMarkts.com seems to follow this pattern, focusing more on appearances than on providing genuine trading services.

The Illusion of Guaranteed Returns

One of the main tactics used by PioneerMarkts.com is the promise of guaranteed profits. The platform claims to leverage advanced algorithms, artificial intelligence, and proprietary trading strategies to ensure consistent gains regardless of market conditions.

In reality, no broker can guarantee profits. Markets are inherently unpredictable, and even experienced traders face losses. By offering unrealistic assurances, PioneerMarkts.com targets hope and greed, appealing to individuals who are either new to trading or seeking quick financial gains without understanding the risks involved.

Regulatory Red Flags

A fundamental aspect of any trustworthy brokerage is proper regulatory oversight. Licensed brokers operate under strict rules to ensure transparency, fairness, and investor protection.

PioneerMarkts.com, however, provides no verifiable evidence of regulation. There are no licensing numbers, no disclosure of financial authorities, and no proof of compliance with industry standards. This lack of regulatory oversight is a significant warning sign. Investors are left vulnerable with no legal recourse if funds are withheld or accounts mismanaged, which is a common tactic of fraudulent platforms.

Aggressive Sales Tactics

Many users report that once they express interest in PioneerMarkts.com, the platform’s so-called account managers employ aggressive and manipulative strategies. Initially, representatives appear friendly, answering questions and offering guidance on trading tools.

However, this demeanor often shifts to high-pressure tactics, with statements like “You must deposit now to secure your position” or “This exclusive opportunity is time-limited.” These strategies are designed to exploit emotions and urgency, pushing potential investors to act hastily without performing proper due diligence.

Deposits and Withdrawal Challenges

Depositing funds on PioneerMarkts.com is straightforward, with multiple payment options such as credit cards, bank transfers, and cryptocurrencies. Early account dashboards often show impressive, simulated profits to lure investors into depositing more money.

Withdrawal attempts, however, reveal significant issues. Investors commonly report:

-

Repeated Document Requests – Verification demands are continuous and often unnecessary.

-

Hidden or Arbitrary Fees – Sudden charges appear to delay or prevent withdrawals.

-

Customer Support Disappearance – Support becomes unresponsive once withdrawal requests are persistent.

These patterns—easy deposits but obstructed withdrawals—are strong indicators of fraudulent behavior.

Inflated Account Balances

Another manipulative tactic is the display of artificially inflated profits on the account dashboard. These fabricated gains create the illusion of success and encourage clients to invest even more, believing their funds are steadily growing.

When users attempt to withdraw these funds, they often find that the profits are fictitious or inaccessible, resulting in financial loss and emotional distress. This strategy is common among scam platforms seeking to maximize deposits from unsuspecting clients.

Website Analysis – Signs of Fraud

Further scrutiny of PioneerMarkts.com highlights additional red flags:

-

Generic or Recycled Content – Text and marketing claims appear copied from other brokerage websites.

-

No Physical Office – The platform provides no verifiable address or contact location.

-

Technical Flaws – Broken links and non-functional features indicate poor operational management.

These elements suggest that PioneerMarkts.com prioritizes image over genuine service.

Victim Experiences – The Human Toll

Accounts from users provide a window into the platform’s manipulative practices. One investor described depositing $1,000 after observing promising account growth. Encouraged by this apparent success, they added another $4,000. When they requested a withdrawal, repeated verification requests, unexpected fees, and eventually complete silence followed.

Another client shared how the dashboard continuously displayed increasing profits, fostering a false sense of security. However, attempts to access these profits proved futile, leaving them frustrated and financially impacted.

These experiences illustrate not just financial loss but also the emotional burden and psychological impact of falling victim to a scam.

Psychological Manipulation at Work

PioneerMarkts.com relies heavily on psychological tactics. By showing rapid gains, creating urgency, and maintaining a friendly initial approach, the platform manipulates emotions such as greed, fear of missing out, and trust in authority.

Recognizing these manipulative patterns is essential for potential investors. Awareness can prevent individuals from making hasty decisions and falling prey to schemes that appear attractive at first glance.

Comparison with Legitimate Brokers

When compared to legitimate brokers, the differences are stark:

-

Transparency vs. Opacity – Legitimate brokers provide clear regulatory information; PioneerMarkts.com does not.

-

Guidance vs. Pressure – Authentic platforms educate clients and provide resources, whereas this platform pressures deposits.

-

Accessibility vs. Obstruction – Real brokers allow straightforward withdrawals; PioneerMarkts.com introduces hurdles and delays.

Understanding these contrasts helps investors avoid falling victim to fraudulent operations.

Broader Implications

Scams like PioneerMarkts.com have consequences beyond individual financial losses. They erode trust in online trading, making it harder for legitimate platforms to gain user confidence. Victims often face emotional stress, anxiety, and long-term hesitation to invest, which demonstrates the broader social and psychological impact of such scams.

Key Takeaways for Investors

From the experience with PioneerMarkts.com, several critical lessons emerge:

-

Verify Licensing – Always confirm a broker is regulated by recognized financial authorities.

-

Be Skeptical of Guarantees – Promises of guaranteed profits or risk-free investments are major red flags.

-

Test Withdrawals – Ensure funds can be accessed without obstruction before depositing significant amounts.

-

Recognize High-Pressure Tactics – Legitimate brokers educate and guide rather than coerce.

Applying these principles can protect investors and help them make informed decisions in the online trading space.

Conclusion

PioneerMarkts.com exemplifies the characteristics of a fraudulent online trading platform. Its polished appearance, exaggerated profit claims, manipulative sales tactics, and obstructed withdrawal policies reveal a clear intention to exploit clients rather than facilitate genuine trading.

Investors must exercise caution, conduct thorough research, and maintain skepticism when encountering platforms like PioneerMarkts.com. The platform serves as a warning: even a professional-looking website can conceal fraudulent intentions.

For those navigating online trading, awareness, vigilance, and critical evaluation are crucial to safeguarding both financial and emotional well-being. PioneerMarkts.com is a stark reminder that not all opportunities are what they seem, and careful scrutiny is essential before entrusting money to any digital broker.

Report PioneerMarkts.com Scam and Recover Your Funds

If you have lost money to PioneerMarkts.com Scam, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like PioneerMarkts.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.