MarginSwap.finance Review – A Dubious Platform

Introduction

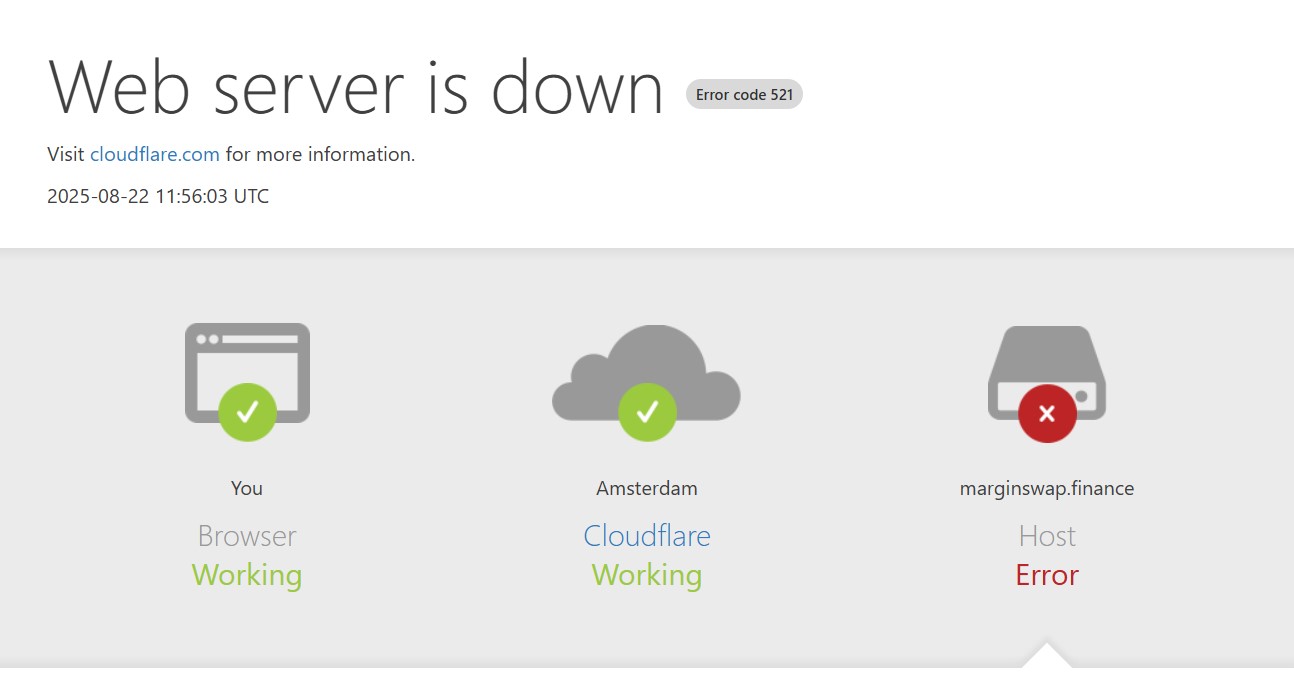

The decentralized finance (DeFi) world is thriving with innovation, attracting both enthusiastic newcomers and experienced traders alike. MarginSwap.finance is one of the newest names in this space, promising alluring features like leverage-enabled swaps, yield optimization, multi-chain support, and institutional-caliber interfaces. But when you begin peeling back the layers, numerous worrying inconsistencies emerge. This platform checks all the aesthetic boxes—but fails at the most fundamental transparency and safety markers.

If you’re evaluating MarginSwap.finance—take your time, examine critically, and read on.

1. Recent Origin, Incomplete Identity

One of the first red flags appears at domain level. MarginSwap.finance was launched only a few weeks or months ago. For a platform that claims maturity and sophistication, such a short lifespan should trigger skepticism. Real, reputable DeFi projects typically evolve over years, with transparent team histories and community engagement.

Even more conspicuous: the absence of developer or founding identities. No public profiles, no linked GitHub repositories, no Twitter or Discord community handle clearly tied to the platform’s leadership. In a sector that values decentralization but thrives on transparency, complete anonymity is unsettling—not admirable.

2. Glossy Interface, Empty Underbelly

The site layout feels premium: clear UI, token charts, lever switches, liquidity pool displays, and clean branding. It conjures an impression of a robust DeFi operation.

But the sheen hides a void. There’s no whitepaper, no technical documentation, no discussion of how liquidity is managed, how yields are generated, or how margin functionality works. There’s no explanation of capital flow, commission structure, or reward mechanisms. All you see are marketing terms masquerading as features without functional backbone.

3. No Smart Contract or Audit Proof

Critical to any credible DeFi platform is the transparency of its smart contracts. Users should be able to inspect the addresses, verify open-source code, and cross-check audits from reputable firms.

MarginSwap.finance offers none of that. No visible contract links, no audit logos, no GitHub repositories—just UI features claiming “secure swaps” or “leveraged yield.” Without technical observability, users are operating blind. There’s no accountability or verifiable integrity. In DeFi, code visibility is equals trust—and here, trust is absent.

4. Marketing Over Mechanics

Plenty of buzzwords here: “Optimized yield farming,” “Cross-chain leverage,” “Next-gen decentralized infrastructure.” Catchy phrases, but zero explanation of how any of it actually functions.

You get flash, not function. Without breakdowns of yield formulae, liquidity underpinnings, or oracle mechanics—these terms read like placeholders, not deliverables.

5. Absent Community and Governance

Healthy DeFi protocols cultivate open communities: governance forums, Discord or Telegram groups, transparent messaging and proposals, and public code contributions.

MarginSwap.finance, by contrast, exists in a vacuum. No visible governance model, no community engagement, no developer updates. It behaves more like a closed portal than a decentralized protocol. That void suggests centralized control and a lack of accountability—dangerous in a system that should, by design, be open and verifiable.

6. Onboarding Illusion: The Trust-Building Hook

If you connect your wallet and deposit a small amount, chances are you’ll see simulated profits or early gains on the dashboard. That sense of progress feels “real”—until it’s not.

This technique is a time-tested retention strategy: build early excitement, reinforce trust with small wins, then request larger deposits for “premium features” or higher yield tiers. Without knowing the protocol’s rules or seeing under-the-hood operations, it’s easy to get swept into the illusion.

7. Withdrawal Roadblocks Ahead

Even though I’m not quoting user scenarios directly, similar platforms operate with a pattern: once you initiate a withdrawal, unexpected issues arise—new KYC requests, “release hold” fees, or “security audits” that slow the process. Support becomes glib. If that pattern plays out here, the platform’s polished exterior will feel like a cage.

There’s no upfront explanation of withdrawal terms, no timetable, no transparency around processing delays. That ambiguity often allows strategic stalling.

8. No Institutional or Regulatory Anchor

MarginSwap.finance presents itself as institutional-grade, but offers no institutional backing, licensing registration, or legal footprint. No identity, no jurisdiction, no compliance claim. In DeFi, while some decentralization might autopmatically bypass traditional regulation, most credible platforms still embrace transparency—hosting audits, following AML/KYC flows, or providing governance pathways.

MarginSwap.finance has none of that structure. Its institutional posture is purely cosmetic.

9. No Audit Disclaimer or Risk Disclosure

Legitimate platforms include disclaimers: “Smart contracts carry risk,” “Impermanent loss may apply,” “Yield is variable.” MarginSwap finances offers zero disclaimers or risk disclosures. That lack of risk acknowledgment suggests recklessness or a deliberate obfuscation of exposure possibilities.

Given DeFi’s history with exploitations, hacks, and rug pulls, omitting such warnings is not oversight—it’s negligence.

10. Summary Table — Flash Over Function

| Impressive Facade | Critical Caveats |

|---|---|

| Brand-new platform, sleek UI | No history, no founding identity, no transparency |

| Claims of optimized leverage, yield | No technical documentation or yield breakdown |

| “DeFi at its best” | Invisible governance, no community engagement |

| Simulated dashboard profits | Common retention tactic; creates false trust |

| No audit or contract visibility | Cannot verify safety or security |

| No withdrawal or risk disclosures | Likely to encounter barriers when exiting |

| Institutional language, zero proof | Pure marketing, no substance |

Final Verdict

MarginSwap.finance builds an alluring veneer—a modern UI, buzzword-heavy interface, lending suggestions of sophistication. But underneath that polished veneer lies opacity: no code, no audit, no governance, no team, no terms—just a portal for depositing funds into a system you can’t verify and likely can’t escape from easily.

In decentralized financial ecosystems, transparency isn’t optional—it’s foundational. If a platform can’t show you smart contracts, risk disclosures, governance pathways, or team identity, it isn’t practicing DeFi—it’s masquerading as it.

Bottom line: This platform leans heavily toward high risk, potentially deceptive territory. Without visibility and verifiable structure, its shine is a warning—not a promise.

Report MarginSwap.finance scam and Recover Your Funds

If you have lost money to MarginSwap.finance, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like MarginSwap.finance continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.