Coinegg Scam Uncovered: A Dubious Platform.

Introduction: Familiarity Designed to Fool

At first glance, Coinegg looks like a credible cryptocurrency exchange—its name echoing better-known platforms and sporting a professional design. But as countless users discovered, this appearance is a façade. Coinegg represents a striking example of a fraudulent exchange that entices hopeful investors into a trap—complete with fake gains, withdrawal barriers, and sudden shutdowns.

The Identity Illusion: A Name That Lulls You In

The slight modification of well-known exchange names makes Coinegg easy to mistake for a peer of trusted platforms. This exploitation of familiarity forms the scam’s foundation: you feel confident switching your funds there—when, in fact, you’re stepping into an engineered web of deceit.

How the Scam Works: A Sinister Blueprint

A. Promised Profit Hook

Buyers were lured by promises of instant, high-yield returns—even claims of doubling investments within 24 hours. Once small deposits were placed, platforms reflected inflated balances—sweetening the illusion of earnings.

B. Swagger Turned Barrier

When users attempted to withdraw, the site introduced hurdles: surprise “taxes,” dubious fees, or endless “verification” delays—all used to extract more money or stall exits.

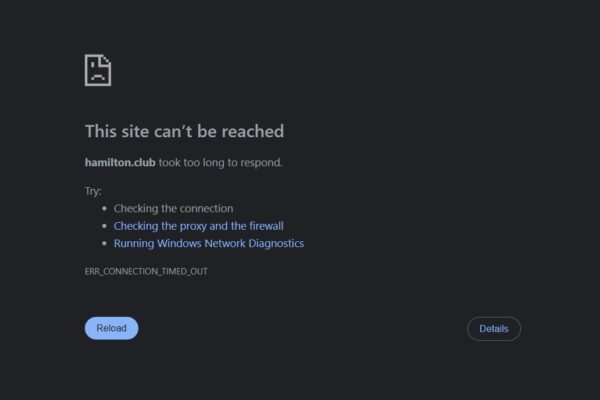

C. Strategic Disappearance

As deposits grew, the platform would abruptly vanish. Websites went dark, support stopped responding, and investor funds became locked forever.

Warning Signals That Get Overlooked

| Warning Sign | What It Exposes |

|---|---|

| Name mimics better-known exchanges | Exploits recognition to lure trust |

| Unregulated and anonymous operations | No legal protection or oversight |

| Unrealistic profit promises | Designed to manipulate emotional gain |

| Fake testimonials or early payouts | Build misplaced confidence |

| Hidden withdrawal fees or “taxes” | Coerces continued depositing |

| Sudden shutdowns with no warnings | Typical exit-scam behavior |

Recognizing these is vital—they aren’t minor red flags; they’re blaring alarms.

User Voices: Frustration from the Front Lines

Online forums show real users recalling harrowing sequences:

“I couldn’t verify—even though I provided correct IDs. I sent BTC in, but no withdrawals, no support reply. Clear scam.”

“Prices were inflated, withdrawal didn’t work. The exchange clearly manipulated coin prices to trap me.”

These firsthand accounts align consistently with the scam blueprint: trust, barriers, silence.

Scam Blueprint in 7 Steps

-

Entrapment: Attractive design and easy access.

-

Deposit: Small initial transaction to test waters.

-

Illusion of Gains: Fake balance jumps.

-

Withdrawal Barrier: Fees, delays, or account restrictions.

-

Pressure to Add Funds: Under the guise of unlocking withdrawal.

-

Fade-Out: Platform disappears overnight.

-

Reuse: Scam re-emerges under a new guise.

This recycling of trust, extraction, and erasure keeps the deception alive.

Broader Scam Landscape: Where Coinegg Fits

Coinegg aligns with a growing ecosystem of scams that:

-

Impersonate reputable names.

-

Offer polished yet hollow user experiences.

-

Entice through quick, fake earnings.

-

Pressure users emotionally via incremental barriers.

-

Vanish and rebrand with alarming agility.

It’s neither random nor isolated—it’s a strategy.

Emotional Fallout: More Than Lost Crypto

Victims report damage deeper than their wallets:

-

Guilt and self-blame, especially after encouraging friends to trade.

-

Eroded confidence, leaving them distrusting even legitimate platforms.

-

Lingering anxiety, turning every new opportunity into a risk assessment hurdle.

This emotional toll is often underappreciated—and persistent.

Branding as a Weapon: Coinegg’s Fake Authority

Coinegg leveraged perceived academic credibility (claiming to be founded by a “PhD AI expert”) and flashy visuals to appear legitimate. But its tactic was clear: masquerade as innovation while cloaking the core that more often traps than trades.

Final Thoughts: When Alertness Is the Best Defense

Coinegg wasn’t clever—it was calculated. It wrapped emotional triggers, design illusions, and familiar names into a camouflage that ruined trust.

If ever faced with unregulated platforms, name mimicry, promised quick returns, or withdrawal hurdles—see them not as excitement but signs. Let this exposé sharpen your scrutiny, not stifle curiosity.

Stay aware. That’s the armor.

Report Coinegg and Recover Your Funds

If you have lost money to Coinegg, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Coinegg continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.

Light

August 19, 2025I regret to inform you that I experienced a significant financial loss due to the fraudulent activities of certain platforms. They deceitfully took all of my life savings, which resulted in substantial debt as I attempted to find additional funds for investment. However, I am pleased to share that JAYEN-CONSULTING>>COM intervened and successfully recouped my funds through legal processes

Don

August 20, 2025I was in a bit of a pickle recently. I had some shady characters trying to empty my Bitcoin wallet, and they kept pressuring me to invest even when I wasn’t seeing any returns. It got to the point where I was starting to lose my mind and my health. But then, thank God, I found JAYEN-CONSULTING”COM. They’re a legit rec()very team, and they helped me get all my money back. If you’re ever in a similar situation, don’t hesitate to get in touch with them. They’re the real deal.