Uniswap.LLC Reviews: A Very Alarming Scam

Introduction: A Familiar Name, Danger Hidden Beneath

When “Uniswap.LLC” popped onto users’ radar, it seemed harmless—after all, the real Uniswap is a trusted name in decentralized finance. But that added “.LLC” was the red flag. This platform wasn’t backed by Uniswap Labs—it was a calculated impersonation designed to steal.

The following analysis tears apart how Uniswap.LLC worked, reveals its deceptive strategies, and explores its emotional aftermath—without suggesting recovery paths.

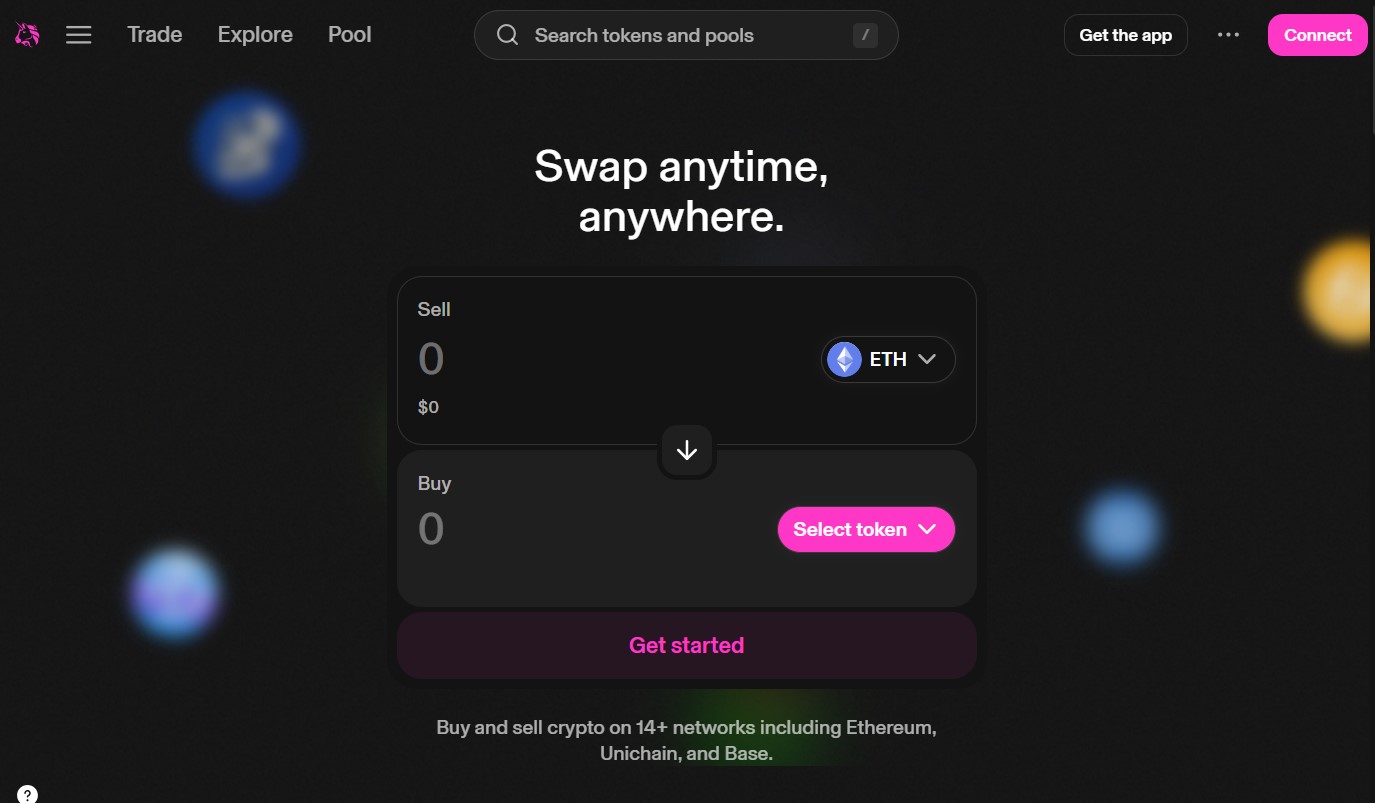

The Masquerade: Mimicking a Trusted DeFi Giant

Impersonation scams like Uniswap.LLC capitalize on brand recognition. By appending “.LLC,” they mimic legitimacy while hiding in plain sight. The name alone creates confusion and lures users to think they’re interacting with something legit.

Once visitors land on the site, they encounter polished messaging—all echoing the DeFi marketplace they think they know, yet offering opportunities that real Uniswap would never endorse.

How the Scam Played Out: A Tragic, Repeating Blueprint

A. Friendly Contact and False Authority

Victims often report being drawn in through trading blogs or messages mentioning “Mr. Charlie” and “Tina,” who claimed to be representatives. Such personal touchpoints aim to create rapport—softening vigilance. The victims are guided to deposit funds, assured they’ll see returns or be able to easily withdraw.

B. Fabricated Gains as Bait

After investing, victims typically see a ballooned account balance—designed to spark excitement and trust. These are staged illusions, not genuine earnings.

C. Withdrawal Roadblocks and Fee Traps

When users attempt to withdraw, the scam floods them with excuses: taxes to be paid, “credit ratings” to meet, or “abnormal wallet activity.” These are outright manipulations aimed at extracting more money, all while denying access to the supposed funds.

D. Disappearance at the Peak of Trust

Once victims are fully trapped, communications stop. The site vanishes. Domains shift. The illusion disappears, leaving users devastated and blocked from any access.

Real Voices Show the Damage

On review platforms, victims speak out:

“Stay clear … big scam. They stole everything I owned.”

“I was unable to withdraw over $600,000 USDT … had to pay $99,000 in ‘capital gains taxes’ … then told I needed to pay 10% more to unlock the withdrawal.”

These statements underscore the cruelty of the scam: inflated balances, demands for escalating payments, and final cutoff.

Red Flags Map: What Should Have Set Off Alarms

| Warning Sign | What It Exposes |

|---|---|

| Name mimics brand (“.LLC”) | Attempts to leverage trust through confusion |

| Anonymous operators | No regulation or accountability |

| Healthy-looking balance spikes | Designed to hook victims with false success |

| Surprise fees and restrictions | Tactics to delay and extract more engagement |

| Final disappearance | Classic exit scam behavior |

In the world of fraud, such red flags are far more than hints—they’re urgent warnings.

Why Users Fall for It: The Emotional Landscape

Familiarity Over Safety

Polished interfaces and recognizable branding override rational alarms. Trust is hijacked through visuals.

Sunk-Cost Fallacy in Full Force

Once a user invests and sees fabricated gains, walking away becomes harder—even as routes to exit are continually blocked.

Social Engineering Through Empathy

Imposters using personable names and casual chats dismantle suspicion. They pretend to help while leading victims deeper into the trap.

Larger Scam Ecosystem: Uniswap.LLC Is No Outlier

This scam knows its place in a broader lineage—one that includes:

-

Impersonation operations, using trusted brands as bait.

-

Phishing via slight domain variations, like “.org” vs “.LLC.”

-

Fake support networks, pressuring users and crafting false empathy arcs.

-

Fee-based resistance: draining trust and cash gradually.

-

Domain swapping upon detection—to evade takedown.

Every element of Uniswap.LLC’s structure reflects a refined playbook adopted by digital fraudsters worldwide.

The Human Cost: Beyond Funds, Into Trust Broken

Victims experience more damage than net worth:

-

Betrayal and embarrassment—especially when inviting others into it.

-

Long-term disillusionment with legitimate platforms due to tainted experience.

-

Emotional exhaustion, as they grapple with guilt, loss, and reduced confidence in their judgment.

Step-by-Step Anatomy: From Entry to Vanishing Point

-

Initial Approach: Hostile or random contact praising “opportunity” under Uniswap branding.

-

Deposit Made: Victim sends funds into an account appearing to grow.

-

Phony Balance Shown: The illusion of success is broadcasted to draw deeper investment.

-

Withdrawal Blocked: Fees, taxes, and excuses mount.

-

Escalation of Requests: Additional payments requested for “release.”

-

Communication Dropped: Support becomes unavailable.

-

Site Disappears: Domain vanishes; access is locked; users left stranded.

Final Thoughts: Lessons from a Copycat Scam

Uniswap.LLC isn’t new—it just cleverly reuses an old, pernicious playbook in an evolving digital landscape. Its strength lies in familiarity and emotional manipulation, not technology.

The antidote isn’t fear—it’s clarity. When platforms mimic known brands, require surprise payments, or miraculously inflate balances, those are not opportunities—they are sirens.

May this breakdown sharpen awareness and protect futures—not stifle curiosity.

Report Uniswap.LLC and Recover Your Funds

If you have lost money to Uniswap.LLC, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Uniswap.LLC continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.