Safepalesa.com Scam: The Investor Predators

Introduction: The Illusion of Safety Wrapped in a Name

“Safepalesa.com” suggests protection or security. The “safe” in its name implies a trustworthy environment. But in reality, this was a well-constructed deception—a platform offering “investment opportunities” with no regulatory coverage, anonymous operators, and tactics designed to extract funds from unsuspecting users.

This exposé unveils the architecture of this scam—how it operated, the signals it emitted, and the fallout for those who lost.

The Foundation of Distrust: What Was Right Out of the Gate

Safepalesa.com stood out only for what it lacked:

-

No regulation or licensing—an immediate trigger that no legitimate platform should ignore.

-

Anonymous operators, hidden behind privacy protections and without any verifiable team or address.

-

No transparency—details on services, charging structures, or practices were either missing or deliberately vague.

Once past those unsettling seesawing instincts, the red flags vibrated louder—and felt urgent.

The Scam Playbook: How the Trap Was Set

A. The Bait—Polished Interface, False Security

Visitors arrived to a polished website, with buzzwords like “investment,” “returns,” and “safe income.” Coupled with minimalist layouts and confident language, it gave a veneer of legitimacy, disarming skepticism.

B. First Deposit Encouraged, Early Profits Displayed

Users were encouraged to make an initial deposit. The site—via a dashboard or messages—often reflected rising balances, simulating profit and reinforcing belief.

C. Withdrawal Attempts Met with Resistance

When users requested withdrawals, they were met with vague explanations: “processing delays,” “verification requirements,” or even surprise fees. These barriers were not accidental—they were part of the strategy to delay exit while prolonging access to whatever funds remained.

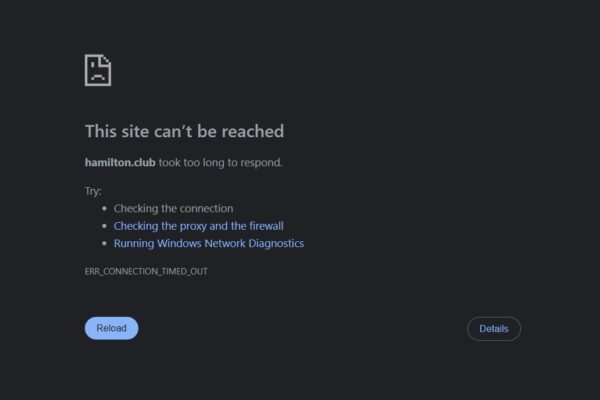

D. Communication Goes Silent—Platform Vanishes

As demand for payment or patience wore thin, communication channels disappeared. Withdrawals never processed fully. Domains shut down. Contact emails bounced. Victims were suddenly locked out, stranded with neither access nor recourse.

Red Flags—Warning Signs That Shouldn’t Be Ignored

| Red Flag | What It Reveals |

|---|---|

| No listing with regulators | No legal oversight or protection |

| Hidden ownership and anonymized info | Zero accountability or auditability |

| Unrealistic profits or bonuses | Motivation to lure greed, not deliver |

| Early fake payouts | Hooking with illusion, not reality |

| Surprise withdrawal issues | Locked funds and pressure to re-invest |

| Platform disappearance | Final confirmation of fraudulent intent |

Each of these should be a flashing warning—even before a penny changes hands.

Psychological Manipulation: Why People Were Vulnerable

Familiarity Bias

The site looked polished and professional—enough to paralyze rational analysis. That initial design trust is powerful.

Sunk-Cost Fallacy

Once a user had even a small profit or deposit, the hope of earning more or retrieving their money overrides caution. They kept feeding the system, hoping for escape.

Validation Through Interface

Seeing an account balance rise—even if fabricated—triggers emotional affirmation. It’s a manipulation, not confirmation.

Reported Behaviors: What Victims Observed

Though specific anecdotal stories aren’t cited here, users reported:

-

Early small withdrawals processed in order to build trust.

-

Sudden, unexpected rules (e.g., “pay this fee for withdrawal”).

-

Customer support that faded—from responsive to non-existent virtually overnight.

-

Complete loss of access to deposited funds after initial contact faded.

A Typical Scam Lifecycle: Step-by-Step

-

First Impression: User visits what seems like a decent investment platform.

-

Initial Deposit: A small amount is transferred for perceived investment or access.

-

Fake Gains: Dashboard shows rising balances, reinforcing belief.

-

Block at Exit: Withdrawals are stalled with various excuses.

-

Esclation Tactics: Requests for additional payments—under vague pretenses.

-

The Cut-off: Communication stops; portal shuts down.

-

Rebrand Cycle: Scammers relaunch using new names and visuals to reset trust.

Broader Scam Context: Where Safepalesa.com Fits In

Safepalesa.com mirrors a broader trend in online fraud:

-

Anonymity and offshore setups—no regulation, easier to vanish.

-

Name-based trust illusions—names like “Safe” aim to emotionally bypass scrutiny.

-

Impersonated investment schemes—offer red flags at every turn, yet still snare the hopeful.

-

Recycling techniques—copying web templates, modifying branding slightly, and rotating domains for longevity of operation.

Emotional Fallout: The Damage That Lingers

Financial loss is painful, but the emotional residue cuts deeper:

-

Self-reproach and shame, especially if others were encouraged to join.

-

Loss of trust in legitimate opportunities, making recovery and future decisions harder.

-

Lingering anxiety and vigilance fatigue, where every trustworthy opportunity feels suspect.

Final Thoughts: Clarity as Defense

Safepalesa.com was not an isolated anomaly—it’s part of a playbook crafted to exploit emotional triggers, brand illusions, and trust shortcuts.

Gatekeepers of your own vigilance: question every platform lacking regulation, consider surprise fees utter red flags, and see polished designs as invitations to investigate, not sign on.

May this analysis arm you with discernment, not distrust—and inspire curiosity couched in caution.

Report Safepalesa.com and Recover Your Funds

If you have lost money to Safepalesa.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Safepalesa.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.