5 Warning Signs of Bytobit.com Scam for Crypto Users

1. Introduction: From Digital Promise to Digital Deceit

In today’s ever-evolving cryptocurrency landscape, “too-good-to-be-true” offers are alarm bells—yet schemes like Bytobit.com persist by cloaking deception in the alluring veneer of innovation. This blog dissects the anatomy of the Bytobit scam: how it enticed victims, the red flags it displayed, and the emotional fallout it left behind.

2. Platform Profile: The Artistry of a Fraudulent Facade

Bytobit presented itself as a modern crypto trading platform—promising fast rewards, seamless integration, and even referral-based earning. It claimed to leverage advanced technologies like cold wallets and MPC (Multi-Party Computation) to protect user assets. But beneath the polished interface lay a dodgy blueprint: users often received small amounts as “proof-of-concept,” only to be blocked from withdrawals unless they deposited more in escalating tiers. Changing identities and rebranded domains were part of its modus operandi, enabling it to evade accountability.

3. Tactics and Mechanics: How the Scam Functioned

A. Initial Hook—Free Crypto Offers and Social Buzz

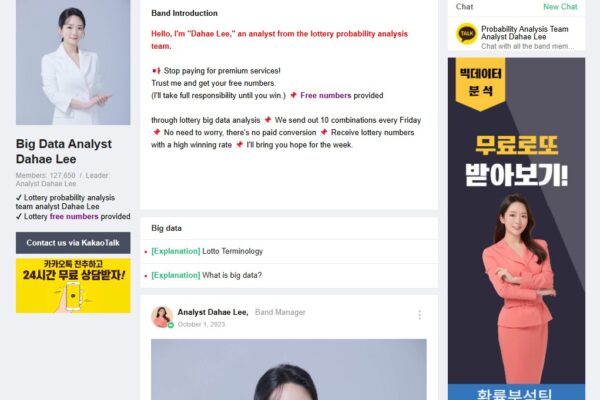

Bytobit lured victims through free crypto giveaways, referral schemes, and social media hype—sometimes even impersonating high-profile figures or offering exclusive bonuses. The goal: build trust and lure victims to sign up.

B. The Withdrawal Wall—Gatekeeping Against Escape

A classic ruse: the site credited your account with crypto but denied withdrawals. Users were told they needed to deposit a small amount—like 0.015 BTC—for “verification.” Once paid, access remained blocked, and another deposit request followed, often under the guise of upgrading to a “premium tier.”

C. Website Churning—Avoidance by Disappearing

Once enough users had been coaxed into depositing, Bytobit would frequently alter domain names or disappear entirely. Accounts were deleted or locked, and contact channels vanished—leaving victims stranded.

D. One Scam, Many Faces

Bytobit didn’t operate in isolation—it was part of a network of clone scams using identical site designs, layouts, and content. This allowed operators to recycle the same trick under different names, keeping operations alive despite mounting warnings.

4. Identifying Red Flags: Patterns That Unravel the Illusion

The scheme exhibited a pattern that betrays its intent:

-

No legitimate contact info—no office address, no regulation identifiers, no verifiable teams.

-

Excessive hype—celebrity mentions, free crypto bonuses, and referral incentives.

-

Poor grammar and sloppy writing—uncharacteristic of professional platforms.

-

Withdrawal obstructions—repeated excuses; requirements to pay before being allowed to withdraw.

-

Rebranding—once flagged or shut out, the same operators resurfaced under a fresh name.

5. Psychology of the Scheme: Why Victims Fall Prey

A. “Free Money” Illusion

Crypto enthusiasm, paired with hype, can blur judgment. When platforms promise easy windfalls, skepticism fades.

B. Sunk-Cost Fallacy at Play

After an initial deposit or partial “profit,” victims hesitate to quit—they hope withdrawing will happen soon, so they deposit more in hopes of escaping unscathed.

C. Social Proof Illusion

Fake testimonials, slick designs, and referral-based success stories reinforce belief—even when there’s no real verification.

8

A common complaint follows this route:

“They credited me .007 BTC to ‘verify’ my account, then demanded .06 BTC for a ‘premium’ upgrade. I lost around $190. I couldn’t withdraw the 10,000 BTC I thought they’d given me—it was all a lie.”

Scenarios like this illustrate the emotional and financial toll—victims feel foolish, violated, and trapped by their own hope.

7. Scam Ecosystem: Where Bytobit Sits in the Broader Landscape

Bytobit is emblematic of a broader class of crypto scams built around giveaway illusions and login entrapment. These schemes often:

-

Rotate identities and domains.

-

Use identical design templates to scale quickly.

-

Deploy pig-butchering elements—establishing false rapport before siphoning funds.

-

Latch onto social media virality to scale reach rapidly.

8. Emotional Aftermath: More Than Just Lost Funds

Victims often face:

-

Shame and embarrassment, especially if they shared referral codes or promoted the platform to friends.

-

Distrust in future crypto ventures—good platforms suffer from collateral damage.

-

Emotional fatigue, beyond monetary loss, as they move from denial to anger to confusion.

9. Table of Deception: The Bytobit Scam Lifecycle

| Stage | Method | Manipulative Tactic |

|---|---|---|

| Social Lure | Free crypto, referral bonuses | Social proof and perceived gains |

| Account Setup | Register with wallet linking | Phishing access + personal data |

| Fake Credit | Small crypto drop into your balance | Build trust |

| Withdrawal Block | “Verification” deposit requests | Escalating demands, no returns |

| Repeat & Rebrand | New domain, same scam | Avoid detection |

10. Final Thoughts: A Caution, Not Just a Story

Bytobit.com is a masterclass in digital confidence tricks—packaged in design-savvy wrappers and emotional manipulation masquerading as opportunity. Its rise and retreat underscore a pivotal lesson for crypto users: the most convincing facades are often hiding the deepest fraud.

May this deep dive serve as knowledge-fortified armor—a sharpened skepticism that protects exploration, not stifles it.

Report Bytobit.com and Recover Your Funds

If you have lost money to Bytobit.com , it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Bytobit.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.