Tbanque.net Scam : The Allure and the Danger

Introduction: The Allure and the Danger

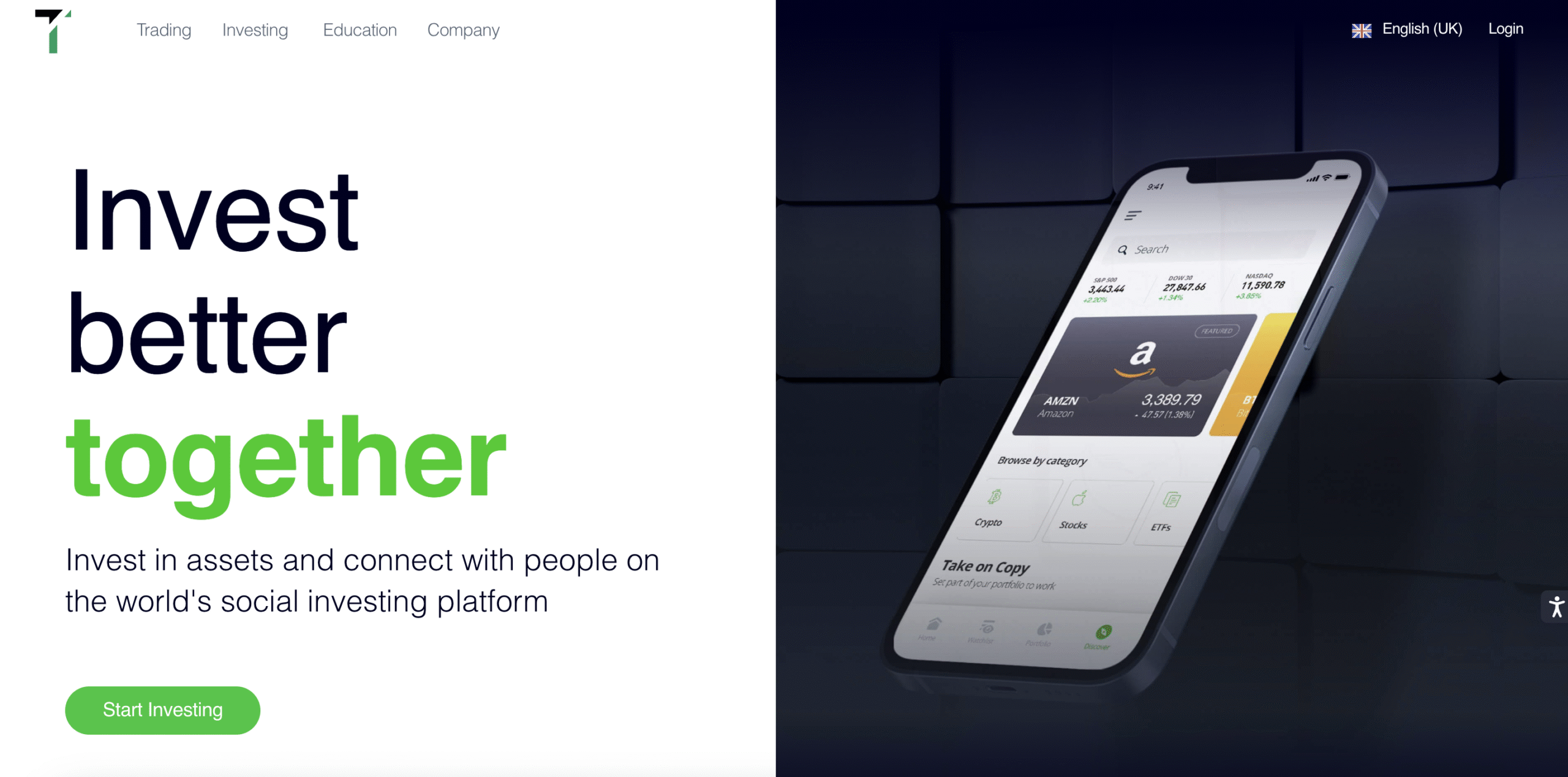

In recent years, Tbanque.net has aggressively marketed itself as a global trading and investment platform—offering services in Forex, CFDs, crypto assets, indices, commodities, stocks, and ETFs. On its website, Tbanque claims regulation under major authorities such as the FCA (UK), CySEC (Cyprus), ASIC (Australia), and registration with FINCEN (USA). But beneath this glossy surface lies a pattern recognized by many watchdogs and victim testimonials: Tbanque.net appears to be an unregulated offshore operation that targets unsuspecting investors. In this article, we expose the key red flags, real warnings issued by official agencies, user experiences, and important steps to protect yourself.

1. Claims Vs. Reality: Regulation That Doesn’t Exist

Tbanque.net markets itself as regulated across multiple jurisdictions. However, independent investigations reveal no records of TBanque being registered with CySEC, FCA, or ASIC:

-

TBanque is not registered with any of these regulators despite claims to the contrary. The FCA issued an official warning stating that TBanque provided financial services in the UK without authorization.

-

In Saint Vincent and the Grenadines, TBanque is registered via Ton Investment Group LLC, but local regulation does not provide Forex licensing—making the regulation claim effectively meaningless.

In short: there is no real regulatory oversight or investor protection for clients of TBanque.

2. Official Warnings from Regulators

Multiple regulators have publicly warned consumers to steer clear:

-

The UK’s FCA issued a warning cautioning that TBanque may be offering services without authorization.

-

The British Columbia Securities Commission (BCSC) in Canada followed with a warning stating that TBanque is not registered to trade or advise in securities or derivatives in BC.

These warnings are strong signals: reputable brokers must be registered and authorized to operate legally in these regions. TBanque is not.

3. Offshore Structure with No Transparency

TBanque’s base in Saint Vincent and the Grenadines raises major concerns:

-

SVG allows easy registration of offshore entities but does not license or supervise Forex or CFD trading.

-

All alleged “global branches” of TBanque appear to be a façade to enhance legitimacy—but there’s no verifiable evidence of operating offices outside SVG.

Additionally, there is no clarity on:

-

Actual identity or track record of the people behind TBanque.

-

Demonstrable financial statements or evidence of segregated client funds.

-

Transparent trading spreads, fees, or conditions—spreads are described as opaque and lacking detail.

4. Platform and Technology: What You Get — and What You Don’t

TBanque advertises its own proprietary “WebTrader” platform and various trading tools. But:

-

It offers no MetaTrader software—widely considered industry standard among trustworthy brokers.

-

Several reports mention broken links, missing demo accounts, and non-functional platform features—raising doubts about reliability even in basic functionality.

In contrast, legitimate brokers commonly provide audited platform performance, transparent data feeds, and account-level proof of execution capability.

5. Client Support and Educational Tools: Few or None

TBanque claims to have round‑the‑clock customer service, educational tools, and newsletters. But reviews indicate:

-

Customer support is “severely lacking or non‑existent.”

-

There’s no clear evidence of real educational content, webinars, or meaningful research tools. The “social investing community” rhetoric appears marketing‑driven rather than user‑verified.

6. Real User Reviews: Warnings from Victims

Especially telling are real-life experiences shared by users:

-

Many describe losing their entire deposit and facing refusal to withdraw funds—accused of owing taxes.

-

Others warn that TBanque promised huge returns but never paid earnings, encouraging victims to hire recovery agencies.

-

Reports of scam victims being unable to recover their money are consistent and widespread.

These reviews echo a consistent theme: deposits vanish, withdrawals are blocked, and promised profits never materialize.

7. TBanque’s Own Statements: A Propaganda Machine

Interestingly, TBanque’s website features a “scam-prevention guide” that aggressively tries to position them as fully regulated and trustworthy:

-

They claim regulation under FINCEN, FCA, CySEC, and ASIC, along with SSL security, client-fund segregation, and zero-spam privacy policies—even while these claims are demonstrably false.

-

The guide warns that “some people who lose money trading blame the platform, calling it a scam,” and frames itself as a responsible provider that encourages responsible trading—even though the brokerage fails to substantiate those legitimacy claims.

In other words, the company’s own materials attempt to preempt criticism—by replicating misleading language while giving zero evidence of truth.

8. Typical Scam Patterns: How TBanque Aligns with Common Schemes

TBanque exhibits many hallmarks of well-known offshore Forex/CFD scams:

-

Encouraging risky, high leverage trading (up to 1:1000) which is prohibited in regulated jurisdictions—signaling a high‑risk environment where traders lose quickly.

-

Requests for additional deposits or “tax” payments before releasing funds—mirroring stories in reviews.

-

Opaque fee structures and leverage terms without clarity or documentation.

-

Refusal to allow legitimate withdrawals, or excessive delays, requiring external recovery services.

9. Risks You Face: Financial, Legal, and Beyond

Engaging with TBanque exposes you to multiple hazards:

-

Complete Loss of Funds

Without deposit insurance, regulatory protection, or oversight, your capital is entirely at risk. -

Withdrawal Blockage

Multiple users report being unable to withdraw earnings or seed capital, or being pressured into paying more. -

Data Exposure and Privacy Breach

You risk handing over identity documents and bank access with no security guarantees. -

Tax or Legal Manipulation

The platform may claim you owe fees or taxes before allowing payouts—classic ransom tactics. -

Account Takeover or Fraud

Lack of encryption guarantees and credible support raises the risk of account hijacking.

10. Comparison to Trustworthy Brokers

By contrast, legitimate regulated brokers adhere to strict standards:

-

Licensed by FCA, CySEC, ASIC, BaFin, CONSOB, etc.

-

Segregated trust‑accounts with Tier 1 banks.

-

Negative‑balance protection, maximum leverage limits (e.g. 1:30 in the EU/UK).

-

Clear fee disclosures, transparent spreads, and independent audit data.

-

Compensation schemes like FSCS (UK) or investor protection of €20,000 (EU).

-

Access to MetaTrader, trading APIs, and verified customer support.

-

Independent third‑party user reviews across Trustpilot, finance forums, and regulators’ registers.

TBanque fails almost all of these criteria.

11. How to Spot and Avoid Platforms Like TBanque

✅ Warning Signs Include:

-

Claims of multiple top-tier licenses, but no presence in official registries.

-

Jurisdiction of Saint Vincent and the Grenadines (SVG) without regulatory oversight.

-

High leverage up to 1:1000, far beyond regulated limits.

-

Broken deposit or withdrawal links, and delays or demands for extra fees.

-

Poor or absent customer support, with no phone verification.

-

Misleading user reviews featuring only glowing praise and no accredited evidence.

🛡 Steps to Protect Yourself:

-

Always check the regulator’s website before opening any account.

-

Test a small withdrawal amount first, before investing heavily.

-

Never pay extra “taxes” or “fees” to unlock profits—regulated brokers never do this.

-

Use only known trading platforms such as MetaTrader or recognized broker-native apps.

-

Report suspicious platforms to authorities like FCA, ASIC, BCSC, or local financial watchdogs.

12. What to Do If You’re a Victim

If you have already deposited funds or attempted to trade with TBanque:

-

Contact your bank or card issuer immediately to attempt chargeback or reversal.

-

Report the case to regulators and to your local police or cybercrime units.

-

File complaints through consumer protection agencies.

-

Avoid third-party “recovery agencies” unless they are clearly reputable.

-

Spread awareness by sharing your experience on review platforms and forums.

13. Voice of Real Users (Selected Quotes)

Many users describe losing their hard-earned money, refusal to withdraw funds, and aggressive pressure to pay additional fees or taxes. The consistent story is one of deception and loss.

14. Final Verdict: Why TBanque.net Is a Scam

When you weigh all of the available evidence—from official regulator warnings, lack of transparency, victim reports, offshore structure, fake claims, and typical scam mechanics—the conclusion is clear:

Tbanque.net is an unregulated offshore broker with no real licenses, crowded with deceptive marketing, targeting vulnerable investors with no recourse.

It meets nearly every red flag checklist for online financial scams.

15. Key Takeaways & Advice

| Feature or Claim | Reality / Risk Assessment |

|---|---|

| Regulation by FCA, CySEC, ASIC | False. No presence in official registries. FCA and BCSC issued warnings. |

| Base in SVG | Unregulated jurisdiction. Offers no meaningful license or regulatory oversight. |

| Trading Platform | Proprietary “WebTrader” only, no MetaTrader, reported broken/demo issues. |

| Leverage Level | Up to 1:1000, widely discouraged and not permitted in regulated markets. |

| Client fund protection | None. No compensation scheme, no negative balance protection or segregation verifiable. |

| Withdrawal procedures | Reports of blocking, extra fee demands, refusal to release funds. |

| Real user reviews | overwhelmingly negative, many reporting complete loss and refusal of refunds. |

| TBanque’s own messaging | Uses regulation language and safety rhetoric despite lack of transparency or verifiable credentials. |

Advice: Avoid Tbanque.net entirely. Instead, choose brokers regulated in your jurisdiction, with verifiable licenses, transparent terms, reputable reviews, and clear compliance credentials.

Conclusion: Don’t Fall for the Illusion

Tbanque.net presents itself as an international fintech success story. In reality, it operates from a loosely regulated offshore base, lacks any credible oversight, and has generated numerous reports of fraud and lost funds.

If you are approached by such a platform:

-

Treat it with extreme caution.

-

Verify every license claim yourself.

-

Use only regulated, transparent, trackable services.

Most importantly, never send money unless you’re absolutely sure the broker is legitimate—and you’ve successfully executed a withdrawal yourself. Scams like TBanque feed on urgency, glamour, and false promises. Don’t let complacency or trust get in the way of critical judgment.

Report Tbanque.net and Recover Your Funds

If you have lost money to Tbanque.net , it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Tbanque.net continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.