JadePacificPartners.com Scam Review: A Dubious Platform

Introduction

In today’s digital age, online investment platforms promise high returns and quick profits, often attracting thousands of users. However, alongside legitimate ventures, there is an alarming rise in fraudulent platforms designed to scam unsuspecting investors. One such platform that has caught attention is JadePacificPartners.com. This review provides a comprehensive analysis of this platform, uncovering the reasons it has been flagged as a potential scam and highlighting the warning signs that every investor should know.

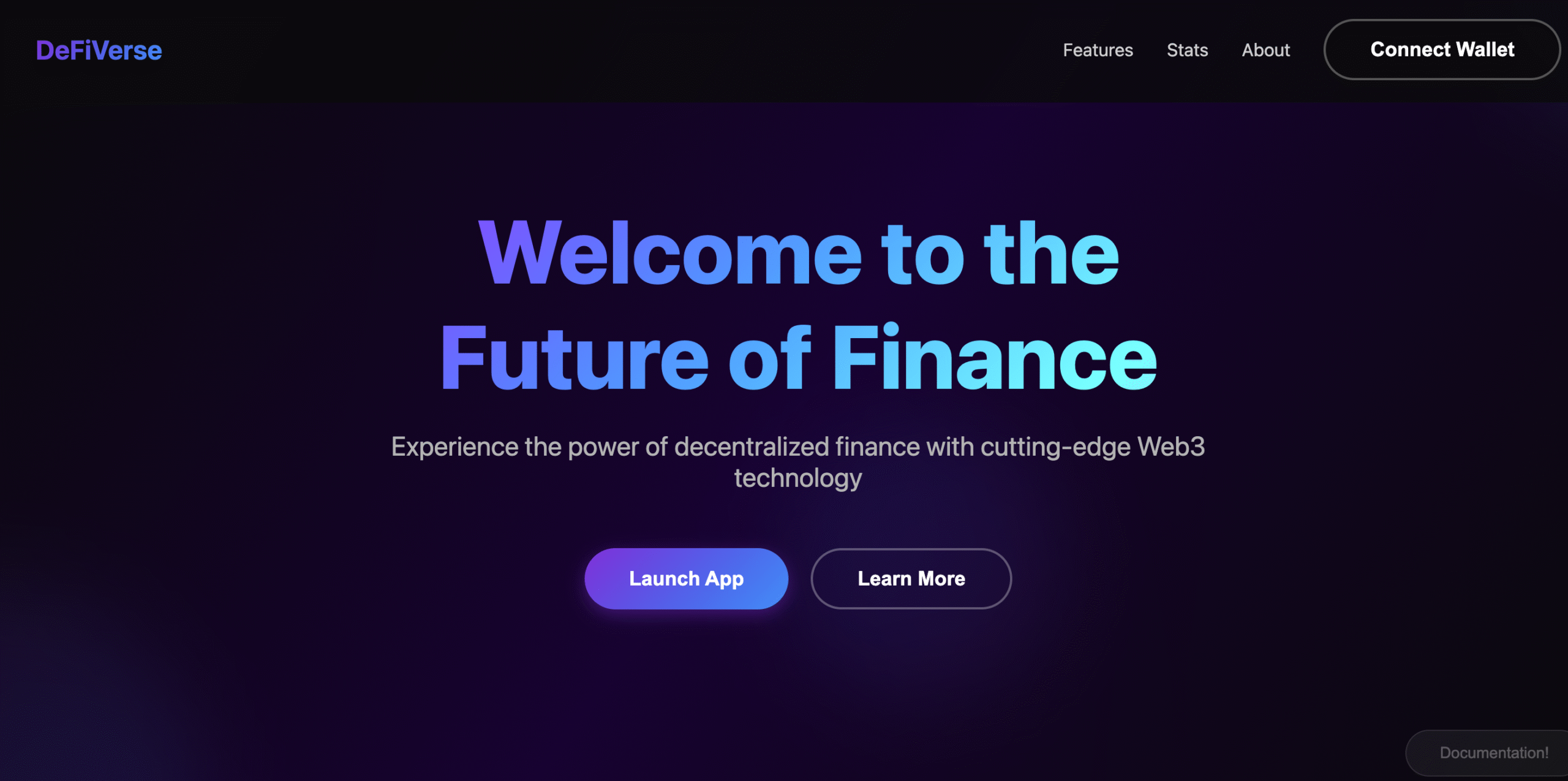

What Is JadePacificPartners.com?

JadePacificPartners.com operates under the brand name DeFiVerse, presenting itself as a decentralized finance (DeFi) platform aimed at revolutionizing blockchain investment. The website claims to offer:

-

Advanced smart contract security,

-

Lightning-fast blockchain transactions,

-

Low transaction fees,

-

Access to over 150 cryptocurrency tokens,

-

Impressive user metrics boasting hundreds of thousands of active users and billions in assets under management.

On paper, these features sound attractive, targeting both novice and experienced investors seeking exposure to DeFi markets.

Red Flags in Platform Operations

While JadePacificPartners.com makes many appealing promises, closer inspection reveals several troubling signs:

1. Lack of Transparency

One of the biggest concerns is the absence of clear information about the company behind the platform. There is no disclosure of the founders, executives, or team members. The platform provides multiple business addresses across the globe — for instance, in Canada and Singapore — but these addresses are unverifiable or unrelated to the company’s operations.

2. Unverifiable Claims

The site proudly displays staggering statistics such as billions of dollars locked in assets and hundreds of thousands of users. Yet, there is no third-party audit, proof, or verifiable data to back these claims. Genuine DeFi platforms typically provide transparent data verified by independent blockchain explorers or audits.

3. Regulatory Non-Compliance

Despite operating in various jurisdictions, JadePacificPartners.com lacks appropriate licensing or registration from financial regulatory authorities. Operating without regulatory approval raises concerns about legality and the safety of investor funds.

Warning Signs in User Experience

Several reports and user testimonials provide insight into how JadePacificPartners.com functions from a customer perspective:

-

Withdrawal Difficulties: Many users have reported challenges when trying to withdraw their funds. Common issues include delayed processing times, unexplained transaction failures, or outright denial of withdrawal requests.

-

Poor Customer Support: Attempts to resolve issues via customer support often result in limited or no response, leaving investors stranded and frustrated.

-

Aggressive Marketing Tactics: The platform appears to use high-pressure sales strategies and guarantees high returns with minimal risk, which are typical tactics employed by scam operations.

The Regulatory Angle

Financial authorities in multiple countries have raised alerts about JadePacificPartners.com:

-

The platform is flagged as operating without a license in key markets.

-

Regulatory agencies emphasize that investors should be cautious and avoid platforms that are not compliant with local laws.

Operating without a regulatory framework means there is no formal oversight or protection for users in case of fraud or mismanagement.

How Scams Like JadePacificPartners.com Operate

Understanding the modus operandi of such scams can help investors avoid falling prey to them:

-

Fake Metrics and Testimonials: Scammers inflate numbers and fabricate user reviews to lure victims into a false sense of security.

-

Ponzi Scheme Features: Funds from new investors are often used to pay returns to earlier investors, creating the illusion of profitability.

-

Withdrawal Restrictions: Once a critical mass of deposits is reached, scammers may block withdrawals or disappear entirely with user funds.

Steps to Protect Yourself

To avoid becoming a victim of scams like JadePacificPartners.com, investors should:

-

Conduct due diligence by verifying licensing and regulatory approvals.

-

Research user reviews and experiences from multiple independent sources.

-

Avoid platforms that guarantee unusually high returns or pressure immediate investments.

-

Use platforms that provide transparency, such as third-party audits and verifiable ownership information.

-

Consult financial advisors before committing significant funds.

Conclusion

JadePacificPartners.com, despite its sophisticated presentation and promises of revolutionary DeFi services, displays multiple warning signs typical of fraudulent investment schemes. Lack of transparency, regulatory non-compliance, unverifiable claims, and negative user experiences collectively indicate that this platform poses a high risk to investors.

In the current financial climate, it is more important than ever for investors to approach online investment opportunities with caution and skepticism. Always prioritize platforms that adhere to regulatory standards and demonstrate clear transparency and accountability.

Final Thoughts

While the world of decentralized finance offers exciting opportunities, it is also a fertile ground for scams. Platforms like JadePacificPartners.com serve as reminders that investors must perform thorough research and maintain vigilance. Protecting your financial future means staying informed, skeptical, and never investing more than you can afford to lose.

Report JadePacificPartners.com and Recover Your Funds

If you have lost money toJadePacificPartners.com, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like JadePacificPartners.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.