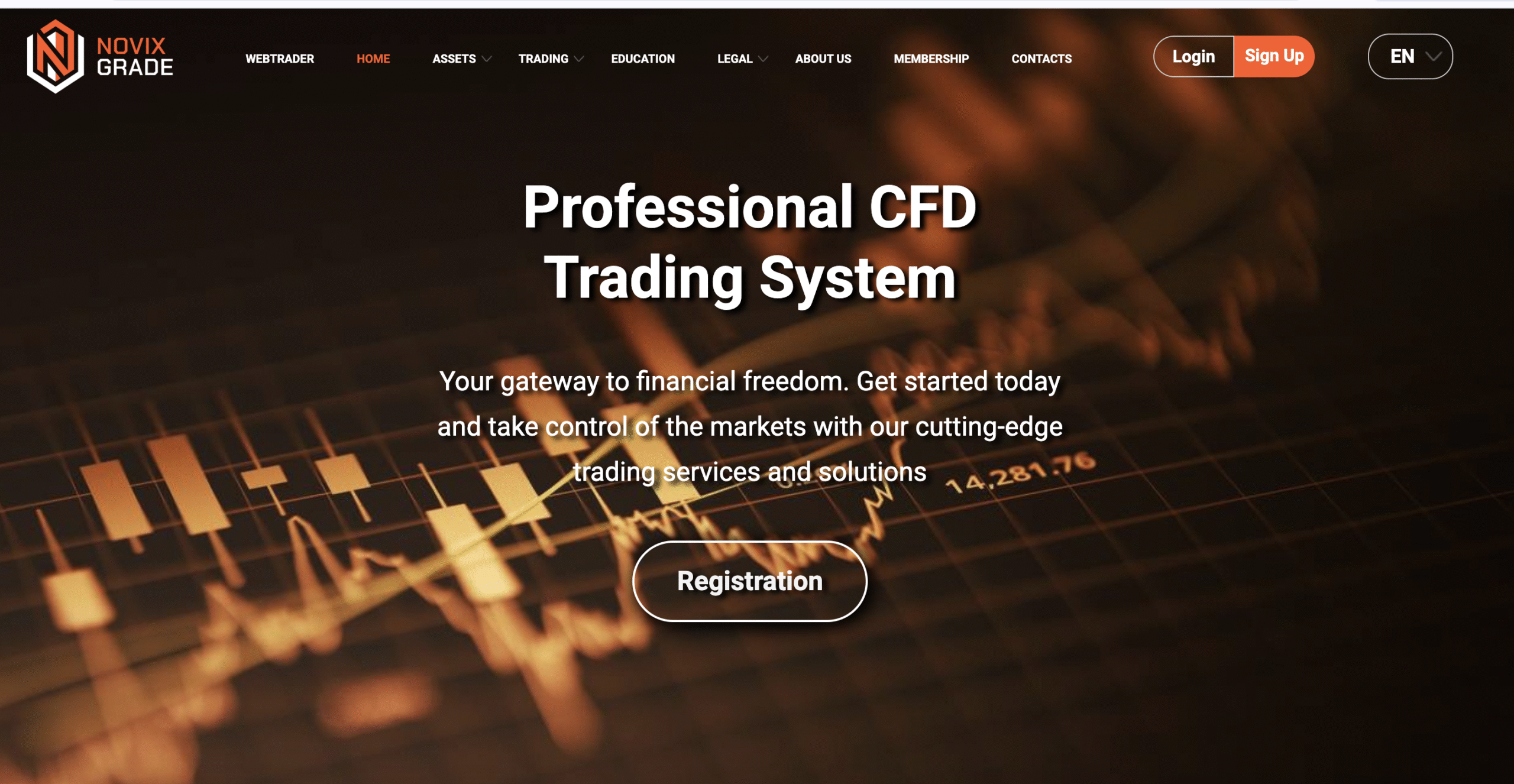

Novixgrade.capital Scam Review: A Fake Trading Platform

1. Professional Summary

Novixgrade.capital presents itself as an online trading and investment platform; however, its publicly observable characteristics exhibit multiple high-risk compliance indicators typically associated with unlicensed financial operations. These indicators include non-transparent ownership, absence of regulatory licensing, aggressive return claims, and patterns consistent with unverified or fraudulent trading environments. Users should proceed with heightened caution when engaging with any platform that demonstrates these risk attributes.

2. Regulatory Compliance Verification

A preliminary compliance review finds no publicly visible evidence that Novixgrade.capital is authorized or supervised by any recognized financial regulatory authority (e.g., FCA, ASIC, SEC, CySEC).

Lack of regulatory authorization typically places a platform outside legally established investor-protection frameworks, including:

-

No oversight of client fund handling

-

No mandated segregation of client accounts

-

No enforceable dispute-resolution mechanisms

-

No compliance audits or operational transparency obligations

This regulatory absence is a primary high-risk factor under standard compliance assessments.

3. Ownership Transparency Analysis

Platforms operating with legitimate financial services registrations typically provide clear corporate disclosures, including:

-

Registered corporate name

-

Physical business address

-

Executive and director identities

-

Jurisdictional registration details

Novixgrade.capital shows minimal or ambiguous ownership data, making it difficult to confirm:

-

Who controls client funds

-

Which jurisdiction governs disputes

-

Whether operators have prior regulatory violations

Opaque ownership is a hallmark compliance gap and a significant Know-Your-Provider (KYP) failure.

4. Platform Operational Integrity Review

Observable concerns associated with the platform’s operational integrity include:

-

No verifiable third-party audit of trading systems

-

Unclear liquidity provider relationships

-

Unverified performance metrics or return claims

-

Withdrawal difficulties commonly reported about similar platforms

The absence of independent infrastructure verification suggests that trading environments may not reflect genuine market execution.

5. Client Case Patterns

Although individual reports cannot be validated within this review, platforms exhibiting similar characteristics frequently follow recognizable patterns:

-

Initial smooth deposits to build trust

-

High-pressure upselling for larger investments

-

Sudden account “locks,” “frozen withdrawals,” or new verification demands

-

Requests for extra fees or taxes before “releasing” funds

-

Disappearance of support channels after withdrawal attempts

Such patterns are consistent with high-risk operational behavior requiring enhanced due diligence.

6. Compliance Risk Index

Compliance Risk Index: ⭐ 0.5 / 5 (Severe Risk)

This low rating reflects highly adverse compliance indicators, including lack of regulatory licensing, opacity of ownership, and risk patterns commonly associated with non-compliant platforms.

7. Key Compliance Failures

| Compliance Area | Status | Notes |

|---|---|---|

| Regulatory Licensing | Failed | No evidence of authorization from recognized financial regulators |

| Ownership Transparency | Failed | No verifiable corporate disclosures |

| Client Fund Protections | Failed | No evidence of segregated accounts or audited custody processes |

| Operational Oversight | Failed | No third-party verification of trading activities |

| Customer Protection Standards | Failed | No dispute-resolution framework or investor safeguards |

8. Expert Advisory Recommendation

Based on the observed red-flags, Novixgrade.capital should be treated as a high-risk, non-verified trading platform.

Clients, prospective users, and compliance officers should:

-

Avoid depositing funds until regulatory status is confirmed

-

Document all interactions for potential reporting

-

Treat any exceptionally high return promises as unsubstantiated

-

Consider the platform unsuitable for any professional or institutional trading activity

9. Suggested Next Steps for Users

-

- Stop All Communication: Once you realize you’ve been scammed, stop any communication with the fraudulent platform. Scammers may try to manipulate you into making further deposits by claiming there’s a way to recover your initial investment.

- Document Everything: Collect all relevant evidence of your transactions and communications with the platform. This includes screenshots of conversations, transaction receipts, and any emails or documents provided by the scam broker.

- Report the Scam: It is important to report the scam to the authorities and relevant online platforms. Websites like JAYEN-CONSULTING.COM provide a detailed process for reporting cryptocurrency scams and ensuring they are documented for investigation.

- Seek Professional Help: Crypto scams are complex and often require professional assistance to recover lost funds. This is where services like JAYEN-CONSULTING.COM come into play.

- For future investments, verify platforms against official regulator databases (e.g., FCA Register, SEC Adviser Search).

Report Novixgrade.capital and Recover Your Funds

If you have lost money to Novixgrade.capital, it’s important to take action immediately. Report the scam to Jayen-consulting.com, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Novixgrade.capital, continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.